jersey city property tax calculator

You can call the City of Jersey City Tax Assessors Office for assistance at 201-547-5132. If you buy 50 or more of the total issued share capital in a company which owns domestic based on rates but broadly equates to residential property immovable property in Jersey or a contract lease of immovable property you must pay Enveloped Property Tax EPTT if the market value of the.

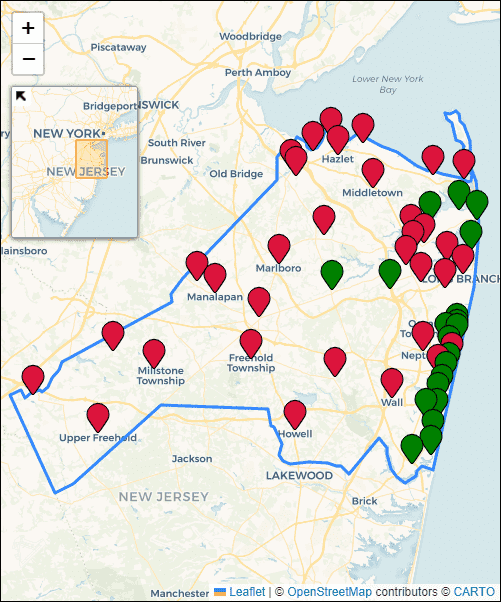

Property Tax Rates Average Tax Bills And Home Assessments For Monmouth County New Jersey

The tax rate for The Oakman is calculated based on current variable factors that may change over time which may cause the rate to vary from the amounts listed.

. Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON ST. Get driving directions to this office. TO VIEW PROPERTY TAX ASSESSMENTS.

Registration is only required once. Remember to have your propertys Tax ID Number or Parcel Number available when you call. For the City of Jersey City W9 Form click here.

Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON ST. Real estate evaluations are undertaken by the county. Office of the City Assessor City Hall Annex 364 ML.

201 547 5132 Phone 201 547 4949 Fax The City of Jersey City Tax Assessors Office is located in Jersey City New Jersey. Ad Get a Vast Amount of Property Information Simply by Entering an Address. Jersey city property tax calculator Wednesday February 16 2022 Edit.

Online Inquiry Payment. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. Property Tax Calculator - Estimate Any Homes Property Tax.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys. The average effective property tax rate in New Jersey is 242 compared to. Property Tax Calculator - Estimate Any Homes Property Tax.

Jersey City establishes tax levies all within the states statutory rules. Please note that you must register your business AND file a return in order for your payment to be properly recorded. Select Advanced and enter your age to alter age.

Enveloped Property Tax Calculator. Below 100 means cheaper than the. The tax rates for the listed municipalities are the rates applicable in 2016 and will be.

For comparison the median home value in New Jersey is. Left to the county however are appraising property issuing levies making collections enforcing compliance and resolving disagreements. Jersey City New Jersey 07302.

You Can See Data Regarding Taxes Mortgages Liens Much More. For comparison the median home value in New Jersey is 34830000. If you have documents to send you can fax them to the City of Jersey City assessors office at 201-547-4949.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Total Tax Savings Years 18-20. Enter Your Salary and the Jersey Salary Calculator will automatically produce a salary after tax illustration for you simple.

Tax amount varies by county. On November 20 2018 the Municipal Council gave final approval to Ordinance 18-133 creating a payroll tax for Jersey City employers. Follow these simple steps to calculate your salary after tax in Jersey using the Jersey Salary Calculator 2022 which is updated with the 202223 tax tables.

King Drive 3rd floor Jersey City NJ 07305 email protected Edward Toloza CTA City Tax Assesor. The median property tax on a 29410000 house is 308805 in the United. To view Jersey City Tax Rates and Ratios read more here.

City of Jersey City. Mumbai Improves Property Tax Accountability Building Society Property Tax Ncr Adding Panels Can Often Improve The Look Of A House Use A Solar Calculator To Find Out About Savings Solar House Residential Solar Solar Panel Cost. Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year.

11 rows City of Jersey City. Use this calculator to estimate your NJ property tax bill. Please call the assessors office in Jersey City before.

189 of home value. Online Inquiry Payment.

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

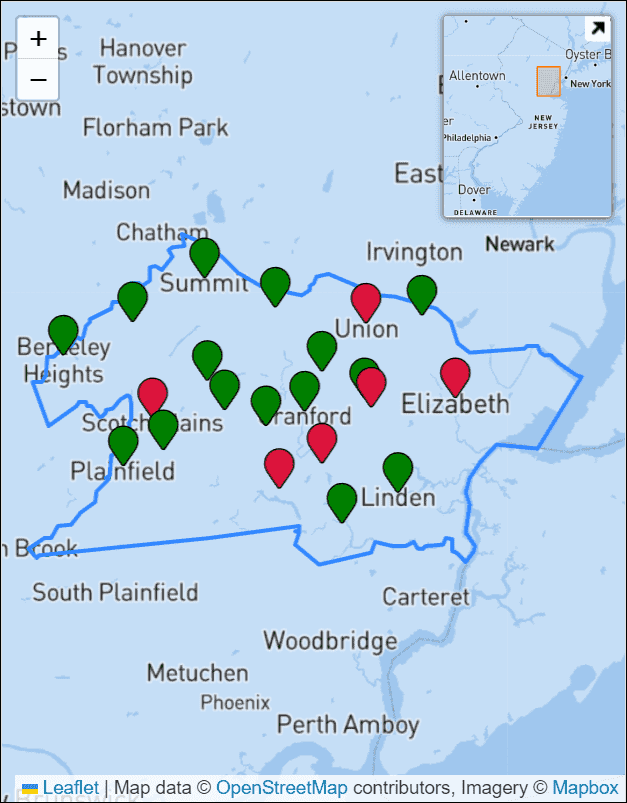

New Jersey 2021 Property Tax Rates And Average Tax Bills For All Counties And Towns

State Corporate Income Tax Rates And Brackets Tax Foundation

Airbnb Bookkeeping Airbnb Excel Template

Property Tax Rates And Tax Bills For Towns In Union County New Jersey

Virginia Tax Rates Rankings Virginia State Taxes Tax Foundation

14 Self Storage Marketing Ideas Marketing Ideas Storage And Cube Storage

7 Tax Benefits Of Owning A Home A Complete Guide For Filing This Year Home Buying Tips Home Buying Home Ownership

Calculate Biweekly Home Loan Payments Mortgage Payment Calculator Mortgage Payment Mortgage Calculator

2022 Property Taxes By State Report Propertyshark

Tax Bill Breakdown City Of Woodbury

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

New York Property Tax Calculator 2020 Empire Center For Public Policy

Township Of Nutley New Jersey Property Tax Calculator

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Nyc Home Prices Plunge After Salt Deductions Capped

Property Tax How To Calculate Local Considerations

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation